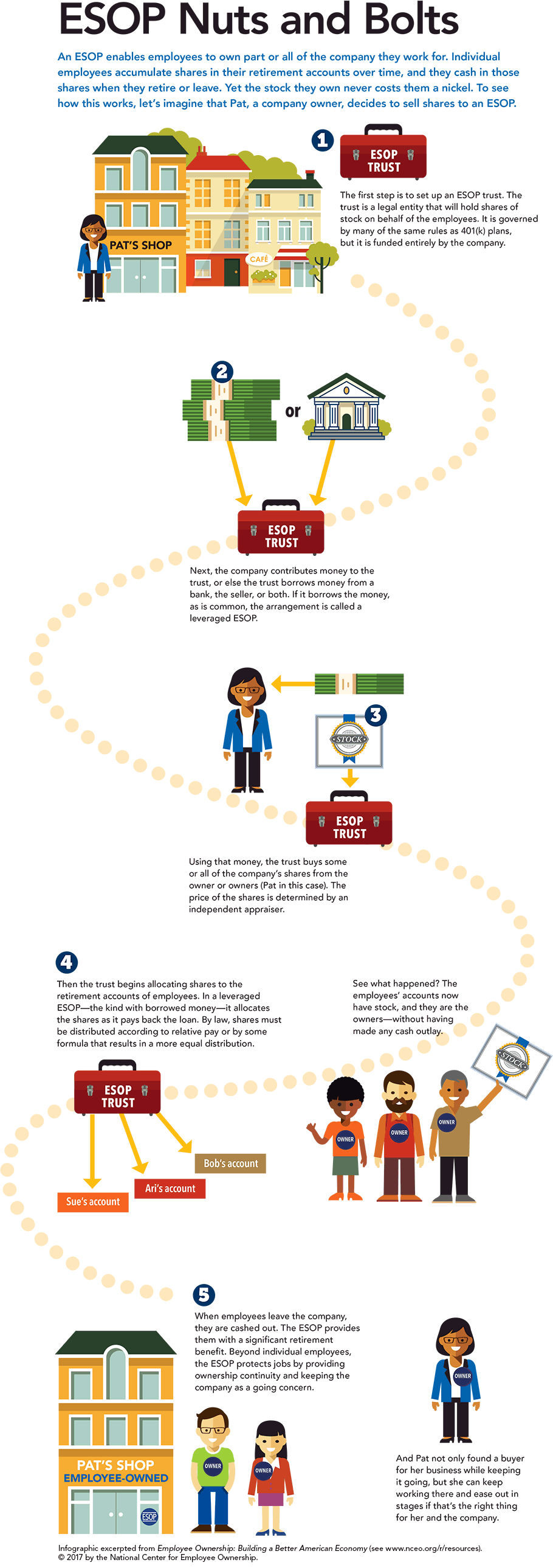

How an ESOP Works

There are several ways through which employees can become the owners of their company, but the ESOP is the main source of employee ownership in the U.S. This is how it works.

In the U.S., the main form of ongoing employee ownership is the employee stock ownership plan (ESOP). An ESOP is a type of employee benefit plan that acquires company stock and holds it in accounts for employees. Many people have misconceptions about ESOPs, thinking, for example, that employees buy the stock or that an ESOP works like an equity compensation plan. The illustration below shows how an ESOP works in a typical case, where it is used to buy out the owner. There also are many ESOPs in public companies, where they often are a component of a 401(k) plan and a minor component of overall ownership, but the explanation here shows an ESOP in its most characteristic form.